No more 48 Hours - Shell's new Fleet Card backbone

In the last issue of Asian Trucker we reported about FEWS, Shell's Fraud Early Warning System. While it was already at the cutting edge of fleet cards, Shell has taken another stab at it to leapfrog the system and push the envelope even further.

Previously, the fraud detection system took some 48 hours to forward the data to the fraud analysts for their review. At that time, Shells' fraud analysts would then evaluate the incident and decide if there is a case of fraud or not. The drawback if this system was by the time the analysts had made their decision on a case, the fraud already happened.

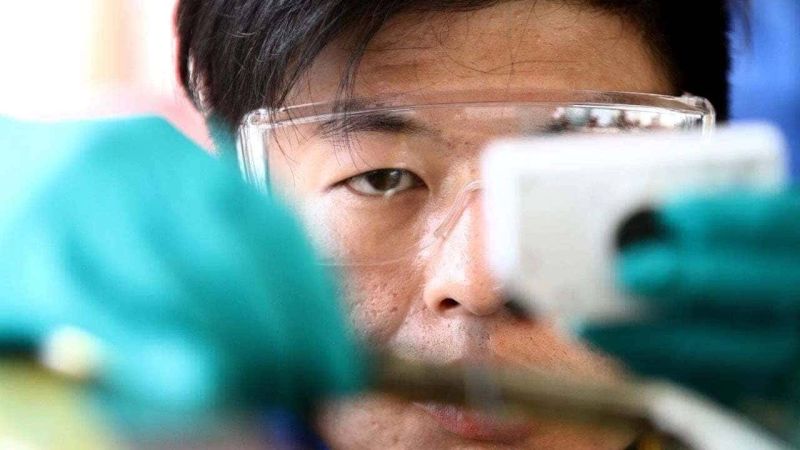

Lim Kee Wa, Shell Regional Commercial Fleet Fraud Case Manager is a known face to us as we have heard from him a few times now during the Shell seminars we are running in collaboration with them. He gives us an update. "Totally Exciting! We are now at the cutting edge of fraud detection and it will help the truck industry so much" is what he says about the new system Shell has just launched. Today, the analysts get the information within 48 seconds of a suspicious activity taking place. This is as real time as it gets according to him. Instead of the alert coming in after the transaction, now the data flows during the process, giving companies a much needed leap on fraudulent drivers or other criminals.

"We achieve this through clever use of online systems and automation of real time rules" Lim elaborates further. Interestingly the risk profile for card fraud is different from country to country. "For Malaysia, for example, we have a very specific profile of the cases that happen. They are not identical with neighbouring countries and we need to adjust the system to the user's needs. We apply the same principle as credit card companies" he elaborates. This is the same as booking a flight online where you now get a notification of a transaction taking place. If you know that this couldn't be, you have the possibility of taking immediate action.

Unfortunately, card fraud is an inherent risk in the Payment Card Industry (PCI) and unfortunately, Fuel Cards for commercial fleets are not free from attacks by Organised Crime Groups or individuals anywhere in the world.

Typically, for Malaysia, card fraud falls into either category:

- Abuse of cards (by drivers and petrol station attendants)

- Counterfeiting

- Use of lost or stolen cards

To understand fraud "you need to look at the fraud triangle", Lim says.

He explains: If people are in financial distress, they take desperate measures. You would need to know your drivers in order to evaluate the risk that they pose. This is something we can highlight, but it is the fleet owner that needs to take action and to get involved with their drivers.

It is easy to say "My boss is making so much money, a few Dollars won't matter" or "No one will know about this" and it is easy to rationalize behaviour.

If you have both of these, all you need is opportunity and theft is easy. However, when you take away the opportunity, the other two won't matter. "With Shell's system in place we can help fleet owners to take away that opportunity to be fraudulent" he concludes.